Alloy Credit Underwriting

No-code, low-code credit underwriting decision engine

4 followers

No-code, low-code credit underwriting decision engine

4 followers

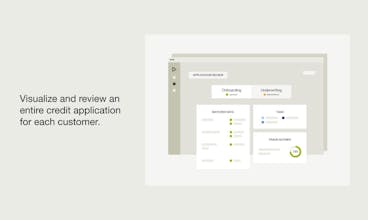

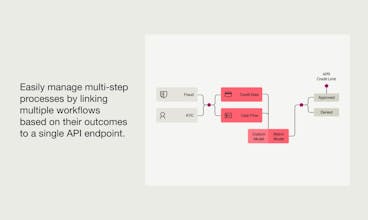

Alloy provides built-in integrations to 120+ data sources for fraud, KYC, credit bureau, and alternative data while also giving you the power to configure and optimize your onboarding and underwriting logic, all via a no-code / low-code decision engine.

Alloy Credit Underwriting

Alloy Credit Underwriting

Buddy

Alloy Credit Underwriting

RateBunni

Alloy Credit Underwriting